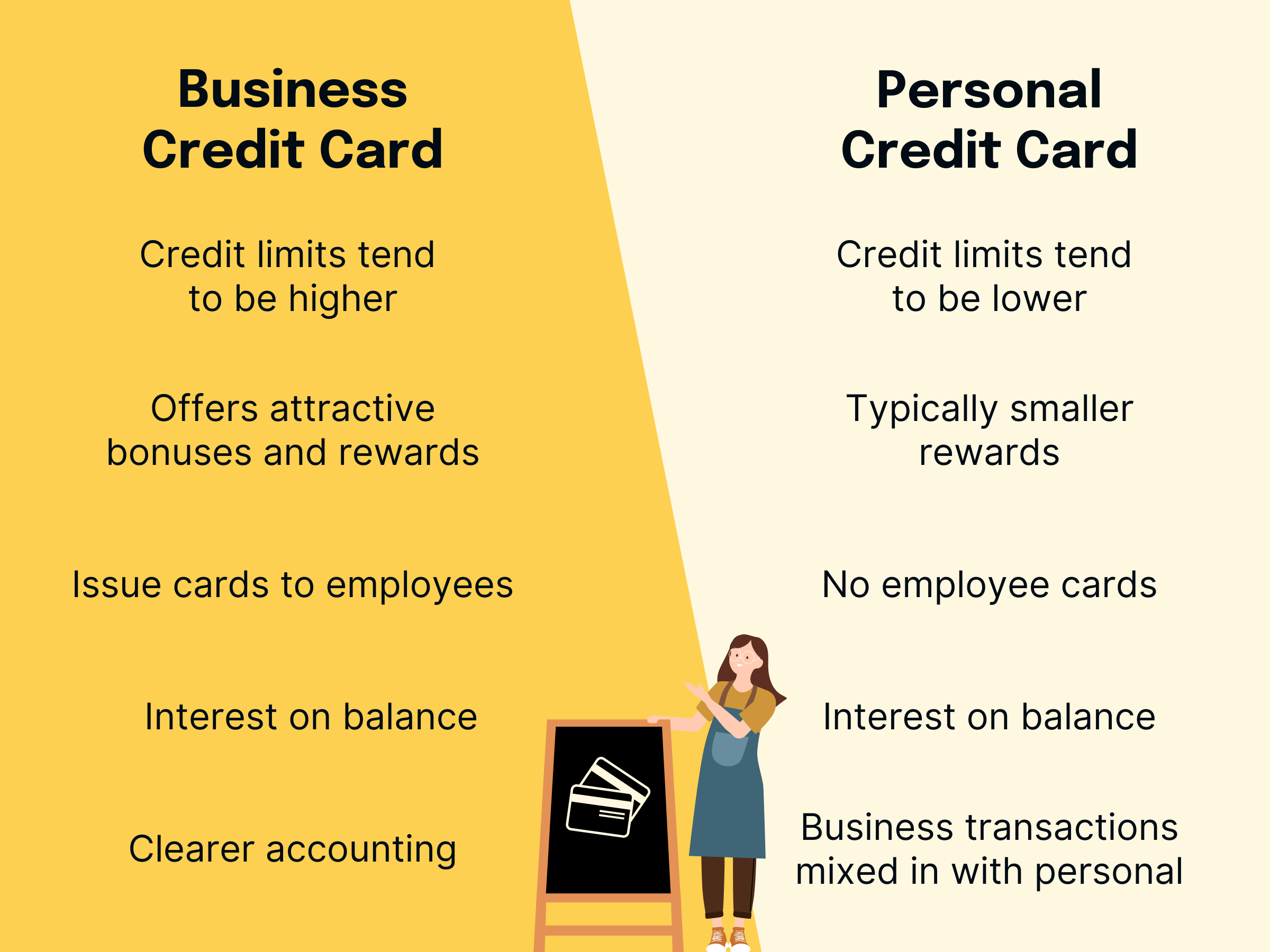

Yes, you can use a business credit card for personal use if it is necessary. However, it is advisable to keep business and personal expenses separate to maintain financial clarity and potential tax benefits.

While there is no strict rule against using business credit cards for personal needs, it is important to be cautious and responsible in your spending habits. Mixing personal and business expenses can lead to confusion and complications when it comes to accounting and tax reporting.

Keeping personal and business finances separate can also help in establishing a clear financial record for both areas and can prevent any potential issues in the future.

Credit: finance.yahoo.com

Credit: www.capitalontap.com

Frequently Asked Questions Of Can You Use Business Credit Card For Personal Use

Can I Use My Business Credit Card For Personal Expenses?

Yes, you can use your business credit card for personal expenses. However, it may not be advisable as it can make bookkeeping and tax filing more complicated. It’s best to keep your business and personal expenses separate to maintain clear financial records.

What Are The Potential Drawbacks Of Using A Business Credit Card For Personal Expenses?

Using a business credit card for personal expenses may result in confusion between business and personal finances. It can also impact your ability to track and categorize expenses accurately, leading to potential discrepancies during tax season. Moreover, it may violate your business credit card’s terms and conditions.

Is It Legal To Use A Business Credit Card For Personal Use?

While using a business credit card for personal use is not illegal, it is generally not recommended. It can create challenges in terms of accounting, taxation, and record-keeping. It’s crucial to consult with your accountant or financial advisor to understand the potential implications for your specific situation.

Conclusion

Using a business credit card for personal expenses can have advantages and disadvantages. It’s essential to understand the terms and consequences before doing so. Always prioritize financial responsibility and consider consulting with a professional for advice tailored to your unique situation.

Ultimately, being informed and thoughtful is key.