Credit: www.forbes.com

Learnings From Past Banking Crises

Banking crises can shake our financial stability. Yet they offer valuable lessons. Studying these can prevent future collapses.

Case Studies And Success Stories

Looking at past successes helps us understand fixes. For example:

- Sweden (1990s): The government took over banks. It cleaned bad assets. Confidence returned.

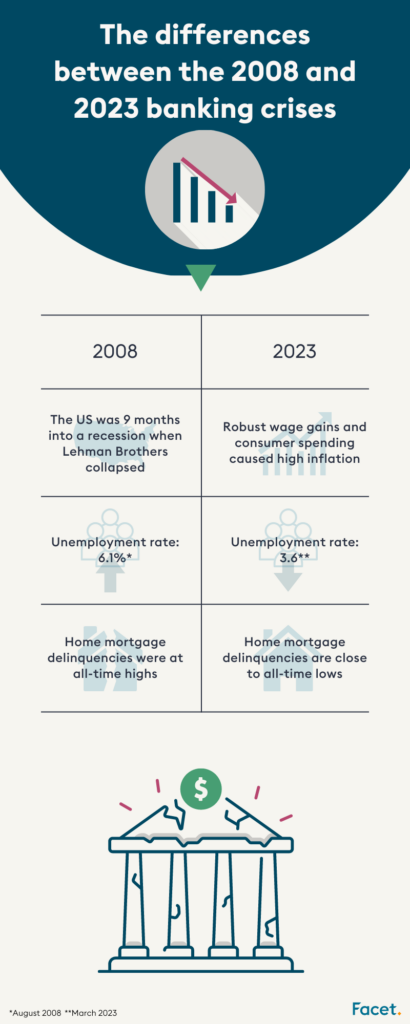

- US (2008 Financial Crisis): Quick actions like bailouts saved key banks. It stopped a bigger crash.

These cases show key steps.

| Action | Impact |

|---|---|

| Government Intervention | Restores trust quickly |

| Tightening Regulations | Prevents bad loans |

| Transparency | Builds long-term trust |

Reforming Banking Practices For The Future

Learning from crises leads to change. Important reforms include:

- Stronger capital reserves: Banks save more for crises.

- Risk management: Banks check risks better. They avoid bad assets.

- Customer education: Customers learn about finance. They make better choices.

Such reforms strengthen banking for everyone.

Credit: www.amazon.com

Frequently Asked Questions For How To Solve Banking Crisis

What Causes A Banking Crisis?

A banking crisis is typically caused by insufficient capital to cover losses, sparked by widespread defaults on loans, poor management, or market turmoil. Economic downturns, loss of confidence by depositors, or systemic banking panics can also precipitate a crisis.

How Can Banks Prevent Future Crises?

Banks can prevent future crises by maintaining adequate capital reserves, enforcing stringent risk management practices, diversifying their loan portfolios, and conducting regular stress tests. Transparency and strong regulatory oversight are also critical to ensure financial stability.

What Are The Signs Of An Impending Banking Crisis?

Signs of an impending banking crisis include a rapid increase in loan defaults, plummeting asset values, liquidity shortages, and a surge in withdrawals. A sharp economic downturn or asset bubbles bursting can also be indicators of an upcoming crisis.

How Does Government Intervene During A Banking Crisis?

Governments intervene during banking crises by providing bailouts, guaranteeing deposits, nationalizing banks, or facilitating mergers. Central banks may also inject liquidity and reduce interest rates to stabilize the banking system and restore confidence among consumers and investors.

Conclusion

Addressing a banking crisis effectively requires decisive action and clear strategies. By implementing robust regulatory frameworks, promoting transparency, and encouraging financial literacy, stakeholders can mitigate risks. The journey towards a stable banking sector is ongoing, but with these tools, resilience is within reach.

Embrace these solutions for a healthier financial future.

Solving a banking crisis involves stabilizing the financial system and restoring public confidence. Governments typically intervene with bailouts, monetary policy adjustments, and regulatory reforms.

Addressing a banking crisis requires prompt and decisive action to prevent economic collapse. Central banks and financial regulators must work cohesively to assess the damage and implement a strategic response. This often involves providing emergency funding to struggling banks or facilitating mergers to ensure consumer deposits remain secure.

Reassuring depositors their savings are protected is crucial to prevent bank runs. In tandem, it’s essential to institute stronger regulatory frameworks to enhance transparency, accountability, and risk management within the banking sector to avoid future crises. Policymakers may also recalibrate monetary policies,lowering interest rates to promote borrowing and spending, so boosting the national economy. Such measures aim to stabilize the banking system, instill confidence among the public, and foster a resilient economic environment.

Early Signals Of A Banking Crisis

Understanding the early signals of a banking crisis can be the key to preventing a full-scale financial meltdown. Like a looming storm, several signs herald the onset of trouble within the banking sector. Identifying these warnings early on allows for timely interventions. Let’s delve into the crucial early signals that can help detect a brewing banking crisis.

Identifying Telltale Economic Indicators

Economic indicators are vital signs of a country’s financial health. Bold changes in these indicators often point to potential banking issues. Here are important signals to watch:

- Rapid credit growth: This might indicate excessive risk-taking.

- Skyrocketing asset prices: Bubbles can lead to crashes.

- High government debt: This suggests possible fiscal instability.

- Wide current account deficits: They reflect economic imbalances.

Monitoring these indicators sheds light on underlying stresses within the financial system.

Monitoring Bank Performance Metrics

Banks have their own set of metrics to indicate well-being. Tracking these metrics is key to gauging the stability of individual banks and the banking sector as a whole. Here’s what to keep an

eye on:

| Metric | Relevance |

|---|---|

| Capital Adequacy Ratio (CAR) | Indicates financial strength and ability to withstand losses. |

| Non-Performing Loan (NPL) Ratio | Higher ratios signal rising credit risks. |

| Return on Assets (ROA) | A measure of profitability; declining ROA can be worrisome. |

| Liquidity Ratios | Low liquidity might mean difficulties in meeting short-term obligations. |

Consistent monitoring helps detect anomalies before they escalate. This proactive approach is essential in managing and solving a potential banking crisis.

The Role Of Regulatory Bodies

Financial stability depends on strong banking systems. Regulatory bodies play a crucial role. They oversee banks and safeguard the economy. Their actions prevent banking crises.

Implementing Stricter Oversight

Regulators must ensure banks follow the rules. They check banks’ health and activities. Strict regulations prevent risky behavior. Regular audits and reviews are crucial.

- Regular Reporting: Banks report their finances. This helps early crisis detection.

- Capital Requirements: Banks must hold enough money. It is to cover sudden losses.

- Supervisory Review: Officials inspect bank operations. They ensure compliance.

Stress Testing And Risk Assessment Protocols

Stress tests simulate crisis scenarios. They reveal banks’ resilience. Risk assessments measure potential issues. Together, they prepare banks for tough times.

| Test Type | Purpose | Outcome |

|---|---|---|

| Stress Testing | Examine impact of adverse conditions | Assess financial strength |

| Risk Assessment | Evaluate threats to stability | Prepare risk management strategies |

Government Interventions And Bailouts

A banking crisis can shake the economy to its core. Banks play a crucial role in financial stability and economic growth. When they face trouble, the government often steps in. Government interventions and bailouts are tools used to prevent financial collapse.

When And How Governments Step In

During a crisis, the government acts to ensure stability. Here’s what typically happens:

- Assessment: Officials check the bank’s health.

- Decision: Leaders choose to give aid or not.

- Action: Assistance begins if it’s needed.

Funds for bailouts often come from taxpayers. Central banks may also cut interest rates. They do this to make borrowing cheaper. They want to boost the economy.

Long-term Impact Of Financial Assistance

Giving help has lasting effects. Some impacts include:

| Impact Type | Description |

|---|---|

| Debt | National debt may grow due to bailouts. |

| Trust | People might trust banks less after a crisis. |

| Regulation | Laws can change to stop future crises. |

Bailouts can save jobs and businesses. But they can also cause higher taxes in the future. Sometimes, these measures are not enough. More advanced solutions may be necessary.

Credit: facet.com

Strengthening The Banking Framework

The backbone of any economy lies in its financial stability, and banks play a critical role. The global economy has seen banking crises that shake the trust of investors, customers, and governments alike. A strong banking framework not only helps in weathering economic storms but also in paving the way for sustained growth. Below, explore how adopting innovative banking models and building resilience through diversification can fortify the banking sector.

Adopting Innovative Banking Models

Innovative banking models adapt to changing markets. They serve clients better.

- Fintech partnerships: Banks work with fintech companies. They create new services.

- Mobile banking: It makes banking accessible everywhere. It is also user-friendly.

- Blockchain technology: It is necessary for transactions to be transparent and safe.

These models reduce costs and improve efficiency. They also fight against financial crimes. Modern technology helps banks stay ahead.

Building Resilience Through Diversification

Diversification is vital for survival. It helps banks manage risks better.

Type of Diversification Benefits

Product Diversification Spreads risk across various financial products.

Geographic Diversification Expands operations. It captures new markets.

Asset Diversification Invests in different asset classes. Reduces volatility.

Resilient banks can withstand economic downturns. They continue to support their customers.

Consumer Confidence And Its Restoration

Trust is the backbone of the banking industry. A banking crisis can shatter consumer confidence. Rebuilding this trust is vital for recovery. Banks must act swiftly and transparently to restore faith among customers. This section discusses effective strategies for reviving consumer confidence post-crisis.

Public Relations Strategies Post-crisis

Communication is key during a crisis. Banks should share clear, honest updates regularly. This openness shows responsibility and dedication to fixing issues. Tailored PR campaigns can highlight positive actions banks are taking. These actions help rebuild public image and restore trust.

- Press releases inform the public about bank improvements and safety measures.

- A dedicated customer helpline provides direct support and reassurance.

- Community outreach initiatives reconnect banks with their local communities.

- Social media engagement encourages transparency and open dialogue.

Educating Customers About Financial Stability

Education empowers. Customers with good financial knowledge are likely to feel more secure. Banks should offer resources to educate their clients.

- Workshops on financial planning and crisis management.

- Online courses covering banking basics and financial health.

- Seminars with experts discussing market conditions and future outlooks.

- Informative brochures with tips for personal financial stability.

Regular updates about financial health of the bank foster trust and confidence. Facts and figures can show solidity and growth potential. These efforts ensure that customers remain informed and reassured about their financial choices.

Credit: www.forbes.com

Learnings From Past Banking Crises

Banking crises can shake our financial stability. Yet they offer valuable lessons. Studying these can prevent future collapses.

Case Studies And Success Stories

Looking at past successes helps us understand fixes. For example:

- Sweden (1990s): The government took over banks. It cleaned bad assets. Confidence returned.

- US (2008 Financial Crisis): Quick actions like bailouts saved key banks. It stopped a bigger crash.

These cases show key steps.

| Action | Impact |

|---|---|

| Government Intervention | Restores trust quickly |

| Tightening Regulations | Prevents bad loans |

| Transparency | Builds long-term trust |

Reforming Banking Practices For The Future

Learning from crises leads to change. Important reforms include:

- Stronger capital reserves: Banks save more for crises.

- Risk management: Banks check risks better. They avoid bad assets.

- Customer education: Customers learn about finance. They make better choices.

Such reforms strengthen banking for everyone.

Credit: www.amazon.com

Frequently Asked Questions For How To Solve Banking Crisis

What Causes A Banking Crisis?

A banking crisis is typically caused by insufficient capital to cover losses, sparked by widespread defaults on loans, poor management, or market turmoil. Economic downturns, loss of confidence by depositors, or systemic banking panics can also precipitate a crisis.

How Can Banks Prevent Future Crises?

Banks can prevent future crises by maintaining adequate capital reserves, enforcing stringent risk management practices, diversifying their loan portfolios, and conducting regular stress tests. Transparency and strong regulatory oversight are also critical to ensure financial stability.

What Are The Signs Of An Impending Banking Crisis?

Signs of an impending banking crisis include a rapid increase in loan defaults, plummeting asset values, liquidity shortages, and a surge in withdrawals. A sharp economic downturn or asset bubbles bursting can also be indicators of an upcoming crisis.

How Does Government Intervene During A Banking Crisis?

Governments intervene during banking crises by providing bailouts, guaranteeing deposits, nationalizing banks, or facilitating mergers. Central banks may also inject liquidity and reduce interest rates to stabilize the banking system and restore confidence among consumers and investors.

Conclusion

Addressing a banking crisis effectively requires decisive action and clear strategies. By implementing robust regulatory frameworks, promoting transparency, and encouraging financial literacy, stakeholders can mitigate risks. The journey towards a stable banking sector is ongoing, but with these tools, resilience is within reach.

Embrace these solutions for a healthier financial future.