The best time to pay your credit card statement is before the due date to avoid late fees and negative impact on your credit score. By paying on time, you can also improve your credit utilization ratio and establish a positive payment history.

Managing your credit card payments effectively is crucial for your financial well-being. Timing your payments correctly can have a significant impact on your credit score and overall financial health. Understanding the best time to pay your credit card statement can help you avoid unnecessary fees and maintain a good credit standing.

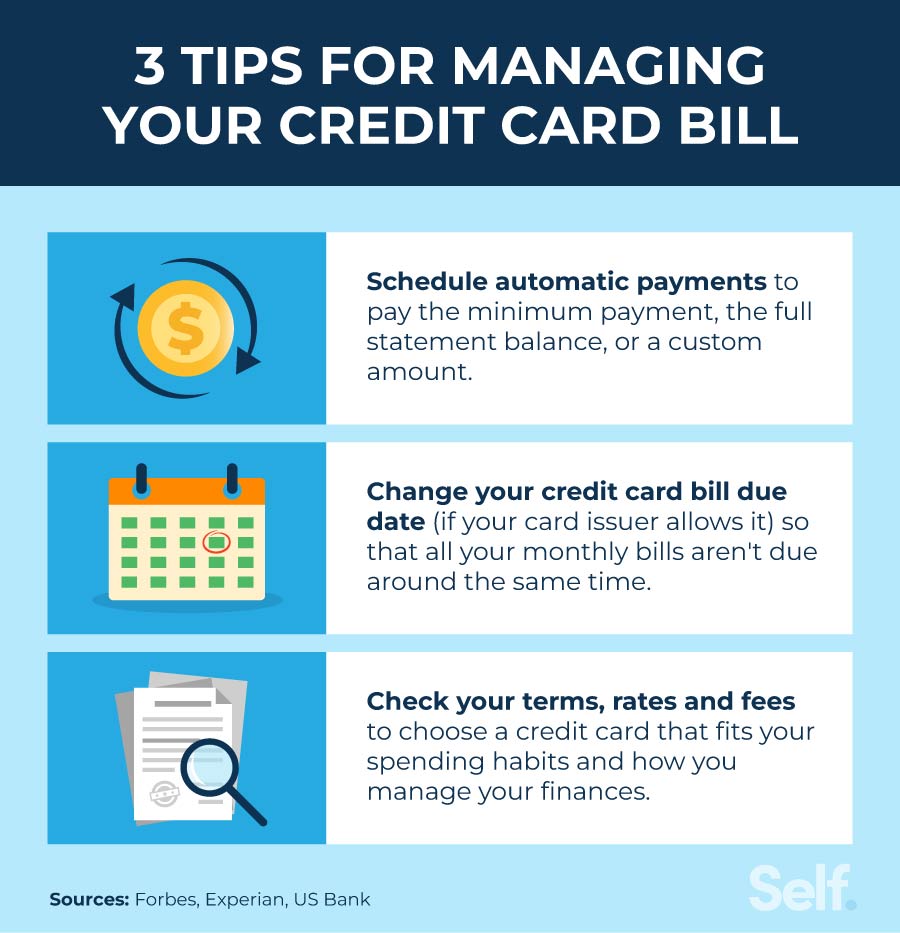

By following some simple strategies, you can ensure that you pay your credit card statement at the optimal time, ultimately saving money and building a stronger financial future.

Credit: www.self.inc

Factors To Consider

Due Date

The due date of your credit card statement is a crucial factor to consider when deciding the best time to make a payment. Missing the due date can result in late fees and a negative impact on your credit score. It is important to make payments before the due date to avoid any financial penalties.

Personal Cash Flow

Your personal cash flow is an important consideration when deciding the best time to pay your credit card statement. It is essential to ensure that you have sufficient funds available to make the payment on time. Understanding your cash flow will help you determine the most convenient time to pay off your credit card balance without causing any financial strain.

Interest Charges

Interest charges play a significant role in determining the best time to pay your credit card statement. By paying off the balance before the due date, you can minimize the interest charges accrued on the outstanding amount. This can help you save money in the long run and avoid accumulating unnecessary debt.

Credit: www.nerdwallet.com

Credit: time.com

Frequently Asked Questions Of When Is The Best Time To Pay Your Credit Card Statement

When Is The Best Time To Pay Your Credit Card Statement?

Paying your credit card statement in full before the due date is the best practice. This helps you avoid late payment fees and interest charges. Ideally, make the payment a few days before the due date to ensure it reaches the credit card company on time.

Can You Pay Your Credit Card Statement Before The Due Date?

Yes, you can pay your credit card statement before the due date. In fact, it is recommended to pay it off in full to avoid interest charges. However, make sure the payment is made at least a few days before the due date to ensure it is processed on time.

Does Paying Your Credit Card Statement Early Affect Your Credit Score?

Paying your credit card statement early does not have a negative impact on your credit score. In fact, it can even have a positive effect as it shows responsible credit management. As long as you make your payments on time, whether it is before or on the due date, it will reflect positively on your credit report.

What Happens If You Miss The Due Date To Pay Your Credit Card Statement?

If you miss the due date to pay your credit card statement, you may be subject to late payment fees and interest charges. Additionally, it can have a negative impact on your credit score. It is important to make timely payments to avoid these consequences and maintain a good credit history.

Conclusion

Finding the best time to pay your credit card statement can help you avoid unnecessary fees and interest charges. By understanding your billing cycle and due dates, you can plan ahead and make timely payments. Remember to prioritize paying off high-interest balances first to save money in the long run.

Stay informed about any changes in terms and conditions as these can impact your payment strategy. Ultimately, by staying organized and proactive, you can effectively manage your credit card payments and maintain a healthy financial profile.