To take out loans for college, the best way is to research and compare available options from private lenders and government programs. Finding ways to pay for college can be a challenging and overwhelming task.

With the rising costs of tuition, many students and their families turn to loans to fund their education. While taking out loans should be approached with caution, it can be a viable option for many individuals. However, it’s important to thoroughly research and compare the available options from private lenders and government programs.

By doing so, you can make an informed decision and choose the best loan package that suits your financial needs and future repayment capabilities. We will explore the best way to take out loans for college and provide some tips for managing your student loan debt effectively.

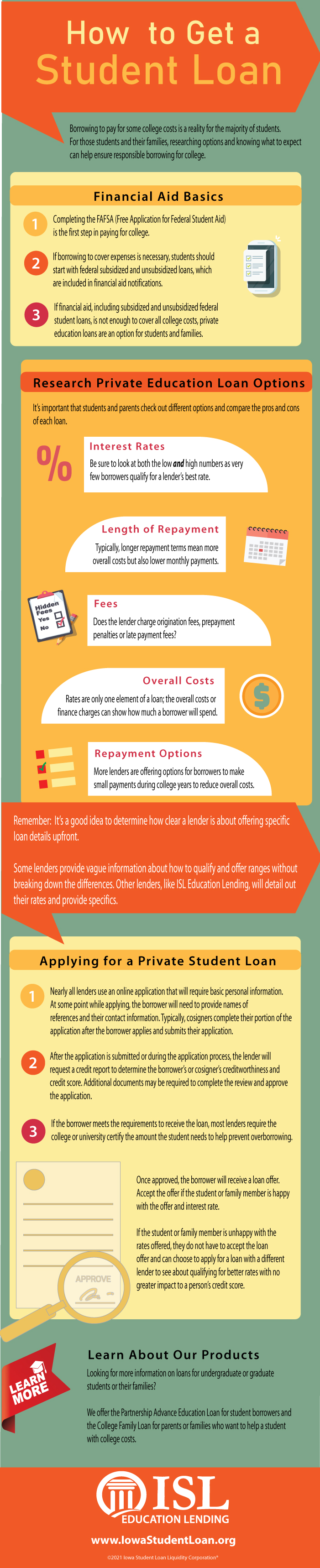

Credit: www.iowastudentloan.org

Understanding Financial Aid

Types Of Financial Aid

Financial aid for college comes in various forms such as grants, scholarships, loans, and work-study programs.

Eligibility Criteria

Eligibility for financial aid is based on factors like income, family size, academic performance, and citizenship status.

Federal Student Loans

Taking out federal student loans is one of the best ways to finance college education. These loans offer fixed interest rates and flexible repayment options, providing students with the financial support they need to pursue their academic goals without the burden of high interest rates or strict repayment terms.

Federal Student Loans When it comes to funding your college education, federal student loans are often a popular choice. These loans, issued by the U.S. Department of Education, offer competitive interest rates, flexible repayment plans, and various options for borrowers. Federal student loans can provide the financial support you need to cover tuition fees, books, and other educational expenses. Let’s take a closer look at the different types of federal student loans available. Direct Subsidized Loans Direct Subsidized Loans are designed to help undergraduate students with financial need. The government pays the interest on these loans while you are in school, during the grace period, and if you qualify for a deferment. It means that the interest doesn’t accumulate during these periods, saving you money in the long run. To qualify for a Direct Subsidized Loan, you must be enrolled at least half-time in an eligible program at a participating school. Direct Unsubsidized Loans Direct Unsubsidized Loans, on the other hand, are available to not only undergraduate students but also graduate or professional students. Unlike Direct Subsidized Loans, interest on Direct Unsubsidized Loans accrues from the time the loan is disbursed. Even though you may not be required to make interest payments while in school, it’s worth considering paying the interest as it accumulates to avoid a larger loan balance upon graduation. To apply for either type of loan, you need to complete the Free Application for Federal Student Aid (FAFSA). The information provided on the FAFSA determines your eligibility for federal student loans and other forms of financial aid. Once your FAFSA is processed, and you’re deemed eligible, your school’s financial aid office will provide you with details about the types of loans you can receive, including the loan amount and interest rate. In conclusion, federal student loans offer a viable solution for financing college education. Direct Subsidized Loans provide interest-free support while you’re in school and other eligible periods, while Direct Unsubsidized Loans cater to a wider range of students. Understanding the options available and completing the FAFSA will be the first steps toward accessing federal student loans that can help you pursue your educational goals.

Private Student Loans

Private student loans are an excellent option for students who need to bridge the financial gap between their scholarships, grants, and federal loans. These loans are provided by private lenders, such as banks and credit unions, and can help cover the cost of tuition, books, and living expenses.

Lenders And Interest Rates

When it comes to private student loans, it’s essential to consider the lenders and the interest rates they offer. Before making a decision, compare different lenders and their terms to find the best option for your needs. Some of the well-known private student loan lenders include:

| Lender | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Bank of America | 4.5% | As low as 3.0% + LIBOR |

| Sallie Mae | 4.2% | Starting from 1.0% + LIBOR |

| Wells Fargo | 3.75% | As low as 3.15% + LIBOR |

Note: Interest rates mentioned above are subject to change and may vary based on your creditworthiness and loan terms.

Credit Score Impact

Your credit score plays a vital role when applying for private student loans. Lenders consider your credit history to determine your creditworthiness and the interest rate you’ll be offered. It’s crucial to understand how taking out a private student loan can impact your credit score:

- When you apply for a loan, the lender will perform a hard credit inquiry, which may slightly lower your credit score temporarily.

- If you make timely payments and maintain a good payment history, your credit score can improve over time.

- On the other hand, missing payments or defaulting on the loan can seriously damage your credit score.

To minimize the negative impact on your credit score, it’s important to borrow responsibly and make consistent, on-time payments.

In conclusion, private student loans can be a valuable resource for financing your college education. By researching different lenders, comparing interest rates, and responsibly managing your loans, you can minimize your debt burden and create a solid foundation for your future.

Credit: nypost.com

Scholarships And Grants

Explore scholarships and grants as a student loan alternative for financing college education. These options can offer financial support without incurring debt, making them a valuable resource for aspiring scholars.

Merit-based Scholarships

Funding based on excellence in academics or extracurricular activities like sports or arts. No repayment necessary.

- Criteria:Usually require high GPA, test scores, or noteworthy achievements.

- Application: Apply directly through the college, organization, or scholarship provider.

- Benefits: Cover part or all of tuition fees, books, and sometimes living expenses.

Need-based Grants

Financial aid awarded based on a student’s demonstrated financial need. Does not require repayment.

- Eligibility:Determined by factors like family income, assets, and number of dependents.

- Submission:Complete the FAFSA form to qualify for federal and state grants.

- Advantages:Assist in covering educational costs for students with limited financial means.

Loan Repayment Options

When it comes to financing college education, loans are often a necessary option. However, managing the loan repayment can be overwhelming. It’s crucial to understand the different options available for loan repayment to create a manageable plan.

Income-driven Repayment Plans

Income-Driven Repayment Plans are designed to make loan repayment more manageable based on the borrower’s income and family size. Some of the popular income-driven repayment plans include:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

These plans calculate monthly payments based on a percentage of the borrower’s discretionary income and can provide loan forgiveness after a certain period.

Loan Forgiveness Programs

Loan Forgiveness Programs offer opportunities for borrowers to have their remaining loan balance forgiven after fulfilling specific requirements. Some key loan forgiveness programs include:

- Public Service Loan Forgiveness (PSLF)

- Teacher Loan Forgiveness

- Perkins Loan Cancellation and Discharge

These programs provide relief for borrowers who work in public service, education, or other eligible fields.

Credit: www.usatoday.com

Frequently Asked Questions On Best Way To Take Out Loans For College

What Is The Best Way To Get A Student Loan?

To get a student loan, you can start by researching different lenders and comparing their interest rates and terms. Then, gather the required documents, such as proof of enrollment and financial information. Fill out the loan application accurately and submit it along with the required documents.

What Kind Of Loan Is Best For College?

The best type of loan for college is usually a federal student loan. These loans typically have lower interest rates, flexible repayment options, and some even offer loan forgiveness programs. It’s important to exhaust all federal loan options before considering private loans to ensure you receive the most favorable terms and benefits.

Is It A Good Idea To Take Out A Loan For College?

Taking out a loan for college can be a good idea to cover educational costs.

What Are The 4 Types Of Student Loans?

The 4 types of student loans are federal student loans, private student loans, subsidized loans, and unsubsidized loans. Each type has its own terms and conditions, so it’s essential to understand the differences before choosing the right one for you.

Conclusion

Choosing the right loan for college is crucial. Research options and find what fits your needs. Prioritize low interest rates and favorable repayment terms. Remember to borrow only what you need. Make informed decisions to secure a bright financial future.

Your education is an investment worth making.