The best time to pay off a car loan is as soon as possible, ideally before the end of the loan term. By paying off the loan early, you can save money on interest and have full ownership of the vehicle sooner.

If you have the financial means to do so, it is recommended to pay off the car loan early to avoid paying unnecessary interest charges. However, before making this decision, it is important to evaluate your overall financial situation and consider any potential prepayment penalties or fees associated with early payment.

Taking these factors into account will help ensure that paying off your car loan at the right time aligns with your financial goals and capabilities.

Credit: www.ramseysolutions.com

Benefits Of Early Car Loan Repayment

When it comes to managing your finances, paying off your car loan early can have numerous benefits. Not only can it save you money in the long run, but it can also significantly improve your credit score, opening up opportunities for better interest rates in the future. In this post, we will delve into the benefits of early car loan repayment, focusing on financial savings and improved credit score.

Financial Savings

Paying off your car loan early can lead to substantial financial savings. By reducing the total interest accrued over the life of the loan, you can free up funds that would have otherwise been spent on interest payments. Additionally, early repayment can alleviate the financial burden of monthly payments, allowing you to allocate those funds towards other financial goals such as saving for a house, investing, or building an emergency fund.

Improved Credit Score

Early repayment of your car loan can have a positive impact on your credit score. By demonstrating responsible financial behavior and reducing your overall debt, you can enhance your creditworthiness. This, in turn, can lead to better terms on future loans and credit products. A higher credit score can also open doors to better opportunities, including lower interest rates, higher credit limits, and improved financial stability.

Factors To Consider Before Paying Off Car Loan

Factors to Consider Before Paying Off Car Loan

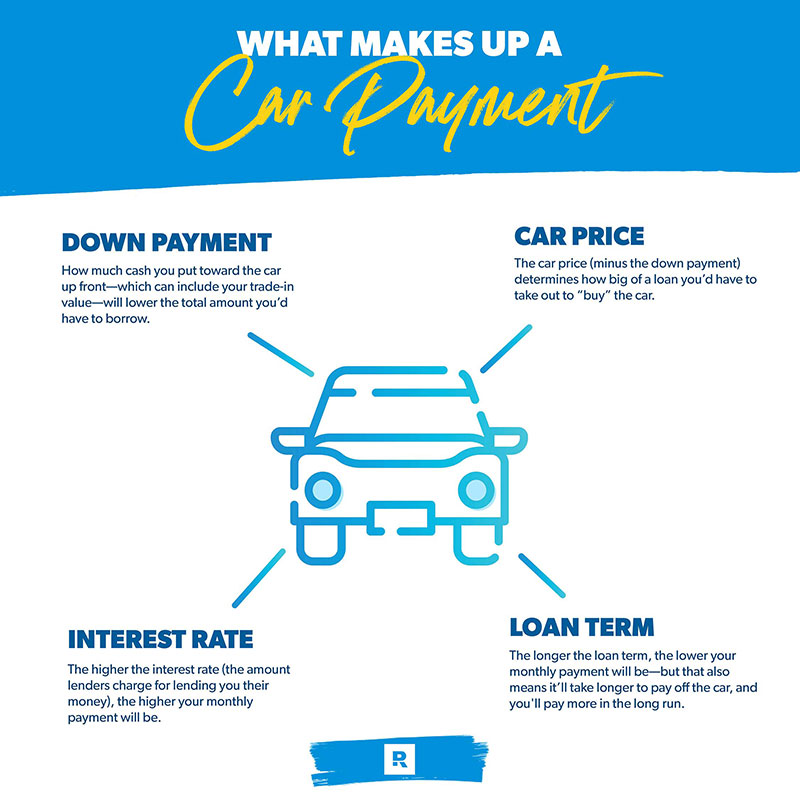

Interest Rate

One of the most crucial factors to consider before paying off your car loan is the interest rate attached to it. Higher interest rates can significantly increase the overall cost of your loan. If the interest rate on your car loan is higher than what you can earn by investing or saving the money elsewhere, it may be beneficial to focus on those investments or savings instead of paying off the loan early.

Other Debt Obligations

It’s important to evaluate your overall debt obligations before deciding whether to pay off your car loan or not. If you have other debts with higher interest rates, such as credit card debt or personal loans, it may be more financially prudent to allocate your resources towards paying off those debts first. Prioritizing high-interest debts can save you more money in the long run.

However, if your car loan is the only debt you have, and you are able to comfortably make the monthly payments along with your other financial commitments, paying off the loan early can provide you with the peace of mind of being debt-free.

Before making a decision, it’s always recommended to assess your entire financial situation, taking into account your income, expenses, and any potential future financial needs. This evaluation will help you determine whether paying off your car loan early is the best use of your resources.

In conclusion, the best time to pay off your car loan depends on various factors, such as the interest rate and your other debt obligations. Consider evaluating your entire financial situation before making a decision.

Remember to always consult with a financial advisor or expert who can provide personalized advice based on your specific circumstances.

Strategies For Accelerating Car Loan Repayment

When it comes to paying off your car loan faster, there are several strategies you can employ. By implementing smart repayment techniques, you can reduce the overall cost of your loan and achieve financial freedom sooner. In this blog post, we will discuss two effective strategies for accelerating car loan repayment: making biweekly payments and increasing your monthly payment amount.

Making Biweekly Payments

One strategy to pay off your car loan quicker is by making biweekly payments. Instead of making a single monthly payment, you can divide the monthly amount into two smaller payments and pay them every two weeks. By doing so, you end up making 13 full payments in a year instead of the usual 12 payments.

Making biweekly payments has several advantages:

- Reduces the interest you pay over the life of the loan

- Shortens the repayment period

- Allows you to reduce the principal balance faster

While some lenders may not offer an automatic biweekly payment option, you can manually set up recurring payments to align with your pay schedule. Be sure to check with your lender for any specific instructions or requirements.

Increasing Monthly Payment Amount

Another effective strategy is to increase your monthly payment amount. By adding extra money to your monthly payment, you can reduce the principal balance faster and save on interest over the life of the loan. Here are some steps you can take:

- Assess your budget: Take a close look at your monthly income and expenses to determine how much extra you can afford to allocate towards your car loan.

- Make a plan: Set a specific goal for how much you want to increase your monthly payment amount and create a realistic timeline to achieve it.

- Automate payments: Contact your lender or set up automatic payments through your online banking to ensure that the increased monthly payment amount is consistently applied to your car loan.

Note: Before making larger payments, be sure to check with your lender if they have any limitations or penalties for prepayment. Some lenders may charge a fee or have restrictions on the maximum amount you can pay per month.

By implementing these strategies, you can accelerate your car loan repayment and save money in the long run. Each method has its own advantages, so it’s important to consider your financial situation and choose the strategy that best fits your needs. Remember, every little bit counts when it comes to paying off your car loan sooner.

:max_bytes(150000):strip_icc()/Heres-how-get-car-no-down-payment_final-1c94e62ad4644532a18289cf826f6cce.png)

Credit: www.investopedia.com

Impact Of Car Loan Payoff On Financial Stability

Paying off your car loan can positively impact your financial stability. Choosing the right time is crucial for long-term financial health. Consider evaluating your current financial situation to determine the best timing for loan payoff.

Debt-to-income Ratio

Lowering or eliminating your car loan can significantly improve your debt-to-income ratio. This ratio is crucial as it directly impacts your ability to qualify for future loans. When your car loan is paid off, your overall debt decreases, which can raise your credit score and give lenders greater confidence in your financial stability.

Future Loan Eligibility

Upon paying off your car loan, your credit score might increase, leading to better terms and interest rates for future loans. Lenders prefer borrowers with a healthy financial profile. Eliminating car loan debt demonstrates responsible financial behavior and can open doors to better loan options, offering you access to more favorable terms and conditions for future credit.

Long-term Financial Planning After Car Loan Repayment

Once you have paid off your car loan, it’s crucial to shift your focus towards long-term financial planning to secure your future. Here are some key strategies to consider after becoming debt-free:

Investing For Future Goals

Investing in a diversified portfolio can help you grow your wealth over time. Consider setting up a retirement account or investing in stocks and bonds. Consult with a financial advisor to create a tailored investment plan.

Building An Emergency Fund

Establishing an emergency fund is essential to prepare for unexpected expenses. Start by saving 3-6 months’ worth of living expenses in a separate account. Prioritize building this fund to ensure financial stability.

Credit: www.marketwatch.com

Frequently Asked Questions For When Is The Best Time To Pay Off Car Loan

Is Paying Off A Car Loan Early Worth It?

Paying off a car loan early can save you on interest and improve your financial situation. It reduces debt and frees up your cash flow for other expenses and investments. Overall, it is worth it if you can afford it without sacrificing essential savings or incurring prepayment penalties.

What Happens If I Pay An Extra $100 A Month On My Car Loan?

Paying an extra $100 every month on your car loan can help reduce the interest you pay over time. It could also allow you to pay off your loan faster and become debt-free sooner. This could ultimately save you money and improve your credit score.

What Is The Best Amount Of Time To Pay Off A Car?

The best amount of time to pay off a car varies, but typically ranges from 3 to 5 years. Shorter loan terms mean higher monthly payments but less interest paid in the long run. It’s important to consider your budget and goals when deciding on a repayment plan.

Is It Better To Pay Off A Car Loan Weekly Or Monthly?

Paying off a car loan monthly can be better for budgeting and managing finances. However, making weekly payments could help reduce interest charges over time. Consider your budget and financial goals when deciding which payment frequency is best for you.

Conclusion

The best time to pay off your car loan is as soon as possible. By doing this, you can save money on interest and free up cash for other financial goals. Consider making extra payments or refinancing to shorten the loan term and minimize overall costs.

Prioritize your car loan payoff to achieve financial freedom faster.