If you experience credit card debt or payment difficulties, there are several steps you can take to address the issue.

Recognizing Credit Card Debt

If you’re struggling to make monthly credit card payments, it’s crucial to recognize the signs of credit card debt early on. By understanding the common causes and signs of credit card debt, you can take timely action to manage your financial situation effectively.

Common Causes Of Credit Card Debt

Several factors can lead to credit card debt, including excessive spending, job loss, medical emergencies, unexpected expenses, and low income. Understanding these causes can help you address the root of your debt and work towards a sustainable solution.

Signs Of Credit Card Debt

- Missing minimum payments

- Maxing out credit limits

- Relying on credit for essential expenses

- Feeling anxious about debt

Recognizing these signs early on can empower you to take proactive steps to navigate credit card debt and avoid further financial strain.

Managing Credit Card Debt

Struggling with credit card debt can be overwhelming, but it’s important to remember that you’re not alone. Many people experience financial difficulties at some point in their lives. The key is to take control of the situation and proactively manage your debt to avoid further complications. In this article, we will discuss a few strategies that can help you effectively handle credit card debt, including creating a budget plan, prioritizing payments, and seeking professional help.

Creating A Budget Plan

One of the first steps towards managing credit card debt is to establish a budget plan. This will enable you to gain a clear understanding of your income and expenses, helping you make more informed financial decisions. To create a budget plan, follow these simple steps:

- List all your sources of income, including salary, freelance work, or any other regular payment.

- Record all your fixed expenses, such as rent, utilities, and transportation costs. Ensure that you include accurate amounts for each.

- Identify your variable expenses, like groceries, dining out, and entertainment. Keep track of these expenses for a month to get an accurate estimate.

- Analyze your expenses and identify areas where you can cut back or make adjustments.

- Allocate a portion of your income towards repaying your credit card debt.

Prioritizing Payments

When facing credit card debt, it’s crucial to prioritize your payments. By doing this, you can avoid late fees, penalties, and damage to your credit score. Follow these steps to effectively prioritize your payments:

- Identify minimum payments: Determine the minimum amount due for each credit card. Ensure that you make at least this payment each month to avoid penalties.

- Identify high-interest cards: If you have multiple credit cards, check the interest rates for each. Start by paying off the card with the highest interest rate first while making minimum payments on the others.

- Snowball method: Another effective strategy is the snowball method. Begin by paying off the card with the smallest balance while making the minimum payments on other cards. Once this card is paid off, use the freed-up money to tackle the next card with the smallest balance.

Seeking Professional Help

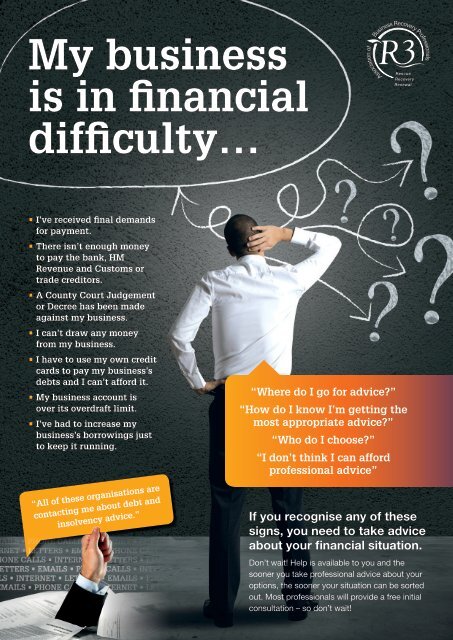

When managing credit card debt becomes overwhelming or you’re struggling to make progress, seeking professional help may be a wise decision. Here are a few options to consider:

- Credit counseling: Credit counseling agencies can provide guidance on budgeting, debt management plans, and negotiation with creditors.

- Debt consolidation: This option allows you to combine multiple debts into a single loan with a lower interest rate, simplifying payments.

- Debt settlement: In some cases, negotiating with creditors to settle for a reduced amount can help you pay off your debt faster.

Remember, managing credit card debt takes time and effort. By creating a budget plan, prioritizing payments, and seeking professional help when needed, you can take a step towards financial stability. Don’t hesitate to reach out for assistance and remember that with patience and determination, you can overcome your credit card debt.

Options For Payment Difficulties

If you find yourself struggling with credit card debt or facing difficulties in making your payments, it’s important to know that you’re not alone. Many people experience financial challenges at some point in their lives, and there are options available to help you get back on track. Here are a few possibilities to consider:

Negotiating With Creditors:

If you’re having trouble making your credit card payments, reaching out to your creditors and discussing your situation can often be a helpful first step. Many creditors have hardship programs in place that can offer you temporary relief. These programs may involve reducing your interest rates, waiving late fees, or providing a modified payment plan that better fits your budget.

By communicating with your creditors and explaining your financial difficulties, you may be able to come to a mutually beneficial arrangement and avoid further penalties. It’s important to remember that most creditors want to work with you to find a solution, as it is often more cost-effective for them to help you in resolving your debt rather than pursuing more aggressive collection efforts.

Considering Debt Consolidation:

If you have multiple credit card debts and find it challenging to manage the payments, debt consolidation could be an option to simplify your finances. Debt consolidation involves taking out a new loan to pay off your existing debts. This allows you to combine all your debts into a single monthly payment with potentially lower interest rates and a longer repayment term.

It’s essential to carefully consider the terms of the consolidation loan, including any associated fees or charges, to determine if it’s the right choice for you. In some cases, consolidating your debts could provide relief and make it easier to stay on top of your payments.

Exploring Debt Settlement Or Bankruptcy:

If your credit card debt has become overwhelming and you see no immediate way to repay it, you may need to explore more drastic options such as debt settlement or bankruptcy. Debt settlement involves negotiating with your creditors to settle the debt for less than what you owe. While this can provide a fresh start, it can also have a significant impact on your credit score. Consulting with a knowledgeable professional is advisable before pursuing debt settlement.

Bankruptcy should be considered only as a last resort. It is a legal process that can discharge certain types of debt or provide a structured repayment plan. However, bankruptcy has long-term consequences and should be thoroughly evaluated with the guidance of a qualified bankruptcy attorney.

Remember, it’s crucial to seek professional advice and thoroughly assess your financial situation before making any decisions regarding debt settlement or bankruptcy.

Financial difficulties can be challenging, but there are options available to help you regain control of your credit card debt. Whether through negotiation, debt consolidation, or more drastic measures, taking action and seeking assistance can lead you towards a brighter financial future.

:max_bytes(150000):strip_icc()/Financial-distress-4196488-recirc-blue-2b75a38cf3714fc493fac849b80b2d63.jpg)

Credit: www.investopedia.com

Preventing Credit Card Debt

Credit card debt can quickly become overwhelming, but you can take steps to prevent it from becoming unmanageable. By implementing some simple strategies and being mindful of your spending habits, you can avoid falling into a cycle of debt and financial stress. Here are some proactive measures to help you prevent credit card debt:

Regularly Monitoring Expenses

Keeping a close eye on your expenses is essential for preventing credit card debt. Regularly monitor your transactions to identify any unnecessary or excessive spending. By staying aware of where your money is going, you can make informed decisions about your purchases and avoid accumulating debt.

Limiting Credit Card Usage

Limiting your reliance on credit cards can help you avoid accumulating excessive debt. Consider using cash or debit cards for everyday expenses and restricting your credit card usage to emergencies or essential purchases. By reducing your dependency on credit, you can control your spending and minimize the risk of accruing unmanageable debt.

Building An Emergency Fund

Having an emergency fund can provide a vital safety net to prevent credit card debt during unexpected financial challenges. Set aside a portion of your income each month to build up a reserve for unforeseen expenses. Having a financial cushion can help you avoid resorting to credit cards to cover emergencies, reducing the likelihood of accumulating debt.

Seeking Financial Education And Support

Handling credit card debt or payment difficulties can be overwhelming, but seeking financial education and support can provide valuable guidance.

Attending Financial Management Workshops

- Learn budgeting techniques

- Get tips on debt management

- Understand financial planning

Utilizing Credit Counseling Services

- Receive personalized financial advice

- Assistance in creating a repayment plan

- Access to debt consolidation options

Credit: www.yumpu.com

Credit: www.facebook.com

Frequently Asked Questions On What Can You Do If You Experience Credit Card Debt Or Payment Difficulties

How To Handle Credit Card Debt Effectively?

To manage credit card debt, start by creating a budget, prioritizing high-interest debts, negotiating with creditors for lower rates, and exploring debt consolidation options. Seek help from a financial counselor if needed.

What Steps Can I Take When Facing Payment Difficulties?

If you’re struggling with payments, contact your creditors to explain your situation, set up payment plans, and seek hardship programs they may offer. Avoid ignoring the issue as it can lead to further financial problems.

Can I Negotiate With Credit Card Companies For Lower Payments?

Yes, you can negotiate with credit card companies for lower payments, reduced interest rates, or waived fees. Be honest about your financial situation, propose a realistic payment plan, and be persistent in your negotiations for a positive outcome.

Conclusion

As you navigate credit card debt, remember you’re not alone. Prioritize essential payments, seek advice, and look into debt relief options. Strive to create a realistic repayment plan that suits your financial situation. With determination and the right support, you can overcome these challenges and regain financial stability.